This appendix contains the following topic:

Steps for W-2 Processing With Hire Act Eligible Employees

The Hire Act was passed into law early in 2010 but was not extended into 2011. You may refer to this documentation as needed. Select the following link for the Instructions for Forms W-2 and W-3:

www.irs.gov/pub/irs-pdf/iw2w3.pdf

With the 12.00.08 Payroll 2010 year-end update Passport provides a means of handling W-2 printing and Magnetic Media reporting of the exempted employer's share of Social Security for employees that are Hire Act eligible.

A list of the changes for the Hire Act processing include:

| • | A new field has been added per employee to identify each Hire Act eligible employee. For year-end processing a new report and update program will accumulate the exempted amount from Payroll history and write it to the Federal Auxiliary file for year-end reporting. |

| • | The new code CC has been added to the box 12 of the W-2 to report the exempted amounts for each employee. |

| • | A new field has been added to the W-2 magnetic media to report the employer's amount exempted for each eligible employee. |

| • | If you do not have any Hire Act eligible employees, as compared to 2009 there are no functional changes for W-2 processing. If you do, include the following steps to your procedure: |

If you have hire act eligible employees, before you print W-2s or run W-2 magnetic media, in Employees (Enter) you must do the following:

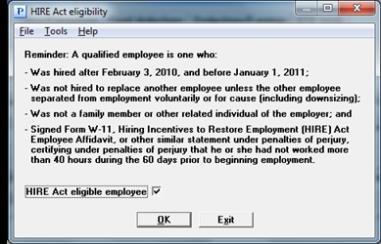

1. Select and edit each Hire Act eligible employee. If no hire date has been entered, then you must first enter the hire date. If the date has been entered then you may select <SF3> and in graphical mode the following message displays:

Check the box. In character mode enter Y. You do not have to select or enter a Hire date for any employees that are NOT hire act eligible. You may check who has been selected by running the new Hire Act List report.

2. Running the Hire Act List

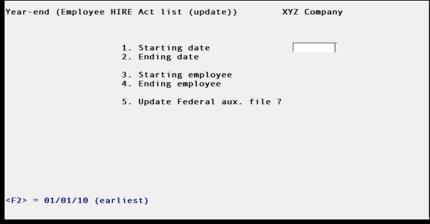

Select Hire Act list (update) from the Year-end menu. A screen similar to the following displays:

When running this as a list only, select N for field five. Viewing the report will tell you by quarter the amounts that are Hire Act Eligible.

3. Once you have confirmed that you have identified all the Hire Act Eligible employees, then you must run the Hire Act List (update) program by selecting Y to Update the Federal aux file.

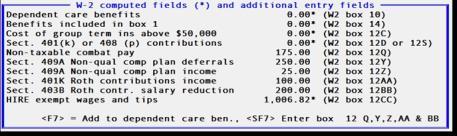

4. You may verify that the Federal Aux file has been updated by selecting Print W-2 information from the Year-end menu. For all employees that have been updated, Box CC will have any amount other than zero. You may also view the amount by selecting Enter W-2 information from the Year-end menu. Enter the employee number and then select <F7> for W-2 box 10, 12, 14 fields. A window similar to the following will display:

Notice that the last line has the Hire exempt wages and tips. If you installed the 12.00.08.01 fix, you may update this field manually by selecting <SF7> and selecting enter through the other fields. Otherwise it cannot be changed.

5. From Enter W-2 information on the Year-end menu you may make any additional changes to other employee deductions.

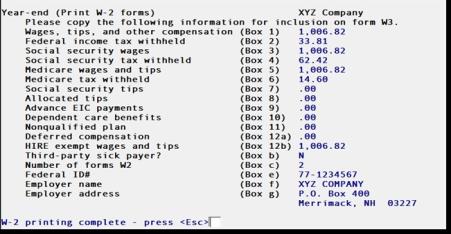

6. Once the amounts are correct, you may print W-2 forms or generate the W-2 magnetic media file. Following the printing of W-2s, a window similar to the following displays:

After generating magnetic media a slightly different, but similar window displays.

When printing W-2s, the sixth line from the bottom has the total HIRE exempt wages and tips (for magnetic media it is the last line on the right). Print this screen or copy the information for inclusion on the W-3 form. Print screen in Windows is <Ctl+P> and in UNIX/Linux it will print to the first printer in Company information with <Sft+F10>.

7. This step is optional. If you have not already done so, you may want to make an adjustment of the FICA employer Social Security wages for each employee. It should be reduced to zero for any Hire Act eligible employees. You may check in Employees (Enter) on the YTD Totals tab the YTD empr soc sec field. To be accurate, this amount should be zero for eligible employees. Even though the employee record amounts are wiped out when the PR year is closed, an adjustment would also update Payroll history and distributions which are more permanent files. If you have already done an adjustment in G/L, then you will need to take that into account.